About ESR关于 ESR

What ESR IsESR 简介

ESR is a leading Asia-Pacific real assets manager and developer focused on industrial/logistics and new-economy infrastructure.

ESR 是亚太地区领先的实物资产管理与开发商,专注于工业/物流及新经济基础设施。

Integrated Platform一体化平台

Origination, planning, delivery, asset management, institutional capital solutions.

涵盖项目挖掘、规划、交付、资产管理及机构资本解决方案。

Why ESR为何选择 ESR

Strong capability in site control, development execution, and facilitating long-term capital at FID. ESR holds the 100% lease.

在场地控制、开发执行及 FID 阶段引入长期资本方面具有突出能力。ESR 持有 100% 租约。

Australia Footprint澳洲布局

Established ANZ platform with local delivery capability.

已建立 ANZ 平台,具备本地交付能力。

Working Model合作模式

Partners bring specialist development/energy capability; ESR structures and sponsors transaction pathways.

合作方提供专业开发/能源能力;ESR 负责交易架构与推进。

Project Overview项目概览

Opportunity Overview机会概览

- Project: 200 MW / 800 MWh BESS

- Location: Prestons, Sydney

- Land position: Under exclusivity, secured via option to lease

- Site size: ~20,000 sqm (BESS + transformers)

- 项目:200 MW / 800 MWh BESS

- 位置:Prestons, Sydney

- 土地状态:已获得排他权,通过租赁期权保障

- 占地面积:~20,000 sqm(BESS + 变压器)

Key Investment Highlights核心投资亮点

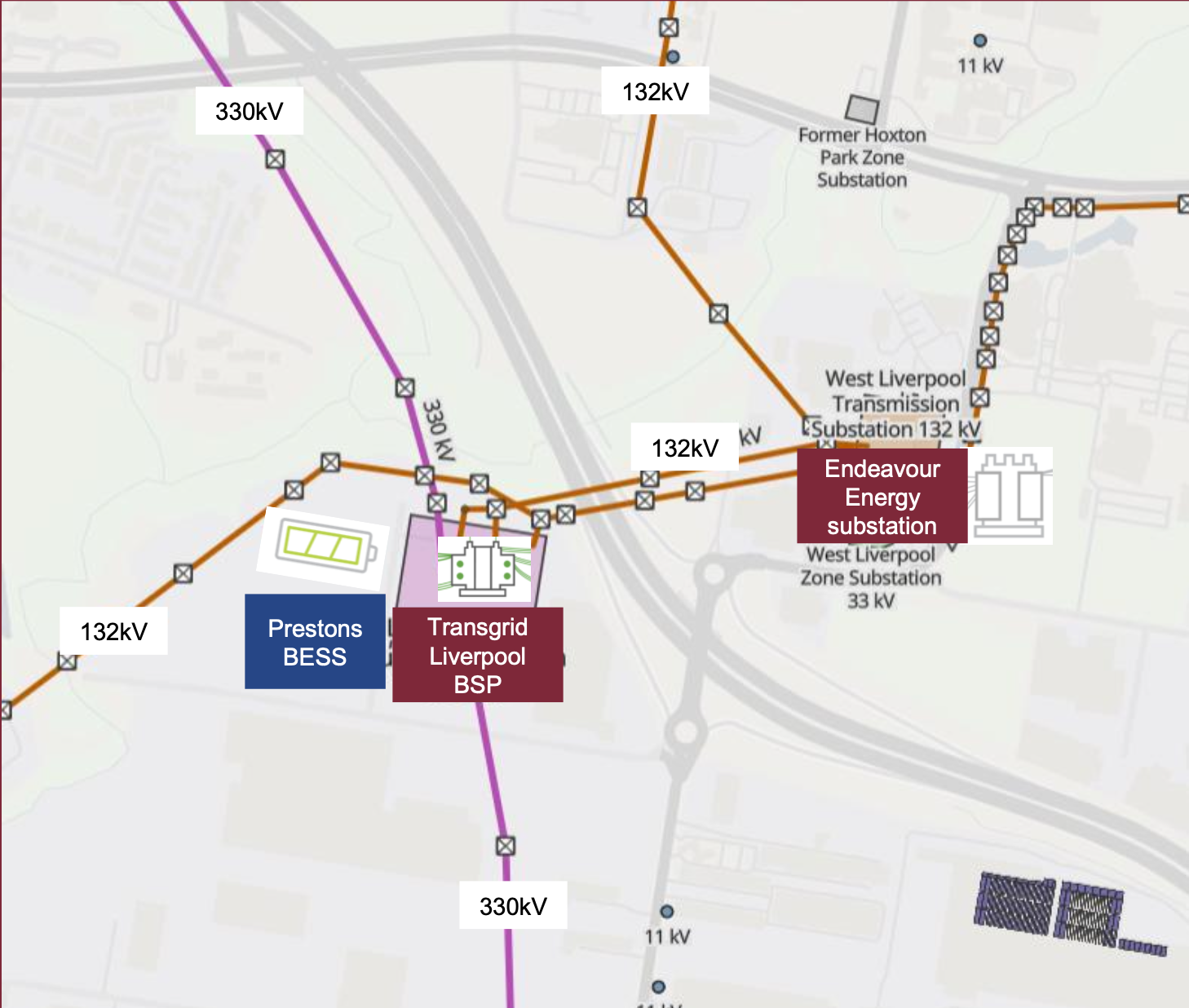

- Directly adjacent to Liverpool 330 kV / 132 kV BSP substation

- Favourable MLF and low network tariffs

- Regular-shaped lot; permissible use for BESS with consent

- High potential for strong offtakes — pathway to highly contracted / potentially 100% contracted offtake

- 紧邻 Liverpool 330 kV / 132 kV BSP 变电站

- 有利的 MLF 及较低网络费用

- 地块规则,可经审批用于 BESS

- 强劲的购电协议潜力——有望实现 100% 合同包销

Site Details场地详情

- Zoning: E5 – Heavy Industrial

- Status: Serviced and flat

- Preparation: Removal of existing small buildings + preparation for BESS footings (landowner deliverables)

- 用途分区:E5 – Heavy Industrial

- 现状:已通服务、地势平坦

- 前期准备:拆除现有小型建筑 + BESS 基础准备(业主负责)

Transaction Process交易流程

- Exclusivity with owner to finalise option deed and ground lease

- Commence option period to conduct due diligence

- Complete development and grid connection approval during option period

- Exercise option and commence ground lease

- Construction

- Commence operation

- 与业主签订排他权,完成 option deed 及 ground lease

- 进入 option period,开展 DD

- 在 option period 内完成 DA 及并网审批

- 行使 option,启动 ground lease

- 施工建设

- 开始运营

Phase 1 Capital RequirementsPhase 1 资本需求

| Item | Cost (AUD) | Start | Duration | End | Notes |

|---|---|---|---|---|---|

| DEVEX — Subtotal: $7,050,000 | |||||

| Detailed Due Diligence | $350,000 | 1 May 2026 | 3 months | 31 Jul 2026 | |

| Upfront Design Costs | $200,000 | 1 Aug 2026 | 3 months | 31 Oct 2026 | |

| Development Application | $3,000,000 | 1 Nov 2026 | 18 months | 30 Apr 2028 | |

| Grid Connection Application | $2,000,000 | 1 Nov 2026 | 18 months | 30 Apr 2028 | |

| Detailed Design & Engineering | $500,000 | 1 Nov 2026 | 18 months | 30 Apr 2028 | |

| Legals, Financing & Commercials | $1,000,000 | 1 Nov 2026 | 18 months | 30 Apr 2028 | |

| ESR FEES — Subtotal: $400,000 | |||||

| ESR Dev Fee | $400,000 | 1 Aug 2026 | 21 months | 30 Apr 2028 | 4% on devex & land holding costs excl. DD |

| LAND HOLDING — Subtotal: $2,875,000 | |||||

| Option Fee ($30/sqm) | $1,200,000 | 1 May 2026 | 24 months | 30 Apr 2028 | Monthly |

| Option Period Outgoings ($40/sqm) | $1,675,000 | 1 May 2026 | 24 months | 30 Apr 2028 | Monthly |

| TOTAL PHASE 1 | $10,325,000 | May 2026 | 24 months | Apr 2028 | |

Why This Site Is Prime选址优势

Grid Connection Advantage并网优势

- Direct adjacency to Liverpool BSP — short feeders (reduced capex + lower losses)

- Ability to connect at 330 kV with capacity to achieve 200+ MW

- Strong fault level support from dual 330 kV in-feeds (Sydney South / Sydney West)

- Lower risk of voltage flicker and harmonics vs weaker regional nodes

- 紧邻 Liverpool BSP——短馈电线(降低资本开支及损耗)

- 可在 330 kV 并网,容量达 200+ MW

- 双 330 kV 进线提供强故障水平支撑(Sydney South / Sydney West)

- 电压闪变和谐波风险低于弱区域节点

Supports Sydney Reliability & Growth支撑 Sydney 可靠性与增长

- Serves a fast-growing load centre

- Anchored by Western Sydney Airport, data centres, commercial users, and growing residential demand

- BESS provides contingency response during outages on Sydney-West corridors

- Helps defer/reduce costly transmission upgrades in South-West Sydney

- 服务于快速增长的负荷中心

- 以 Western Sydney Airport、数据中心、商业用户及住宅需求为支撑

- BESS 可在 Sydney-West 走廊故障时提供应急响应

- 有助于延缓/减少 South-West Sydney 显贵的输电升级

Revenue Optimisation in the NEMNEM 收益优化

- Located in Sydney load zone — stronger arbitrage margins

- High MLF (>1) due to proximity to load — avoids long-distance transmission losses

- Access to all 8 FCAS markets (regulation + contingency; raise/lower)

- 位于 Sydney 负荷区——更强套利空间

- 高 MLF (>1),贴近负荷,避免远距离输电损耗

- 可参与全部 8 个 FCAS 市场(调频 + 应急;升/降)

System Strength & Technical Services系统强度与技术服务

- Enhances system strength in South-West Sydney (important for incoming data centre loads)

- Contributes to AEMO performance standards

- Potential to contract with Transgrid/AEMO for non-market ancillary services (network support / system security)

- 增强 South-West Sydney 系统强度(对新增数据中心负荷至关重要)

- 符合 AEMO 性能标准

- 可与 Transgrid/AEMO 签约提供非市场辅助服务(网络支持 / 系统安全)

Development Program & Decision Gates开发计划与决策节点

| Workstream | Q1 '26 | Q2 '26 | Q3 '26 | Q4 '26 | Q1 '27 | Q2 '27 | Q3 '27 | Q4 '27 | Q1 '28 | Q2 '28 | Q3 '28 | Q4 '28 | Q1 '29 | Q2 '29 | Q3 '29 | Q4 '29 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Agreement in principle (HOA) | ||||||||||||||||

| Partner & ESR project approval | ||||||||||||||||

| Execute HOA / Term Sheet | ||||||||||||||||

| Finalise landowner legals | ||||||||||||||||

| Preliminary enquiry | ||||||||||||||||

| ESR pre-DD | ||||||||||||||||

| ⬥ Rudder Go / No-Go Gate | ||||||||||||||||

| Detailed due diligence | ||||||||||||||||

| ESR & partner final approval | ||||||||||||||||

| Upfront costs | ||||||||||||||||

| Development application (DA) | ||||||||||||||||

| Grid connection application | ||||||||||||||||

| ★ NTP / FID | ||||||||||||||||

| Exercise lease | ||||||||||||||||

| OEM procurement | ||||||||||||||||

| Construction & commissioning | ||||||||||||||||

| ★ COD |

Key devex Supporting Ancillary Post-FID Milestone Decision Gate

Key Term Sheet PointsTerm Sheet 核心条款

Parties & Structure合作方与架构

- Investment vehicle (JV / Venture SPV) between ESR and Rudder

- Rudder holds 90–95% of shares and contributes 90–95% of capital (majority control)

- 由 ESR 与 Rudder 设立投资载体(JV / Venture SPV)

- Rudder 持有 90–95% 股份并出资 90–95%(多数控制权)

Capital Contributions资本出资

- Staged contribution schedule

- Each stage budget reviewed in IRC and confirmed by Rudder

- Overspend protection: if actual spending is >10% over the agreed estimate, ESR covers the excess

- 分阶段出资计划

- 每阶段预算经 IRC 审查并由 Rudder 确认

- 超支保护:实际支出超过商定估算 >10% 时,由 ESR 承担超出部分

Fees费用

- ESR Development Fee: 4% (applies to pure devex; excludes land-related holding costs)

- Project Acquisition Fee: capped at AUD 500k (negotiated down from AUD 1m), payable upon FID realisation

- ESR Development Fee:4%(仅适用于纯 devex,不含土地持有成本)

- Project Acquisition Fee:上限 AUD 500k(已从 AUD 1m 谈下),FID 实现时支付

Exit / Reinvest Rights退出 / 再投资权利

- Rudder can exit at FID (end of Phase 1)

- Exit price set by independent third-party valuer appointed/elected by Rudder

- Alternatively Rudder may roll shares into Phase 2 (build-own-operate to COD)

- If rolling, conversion is based on the FID sale price

- Rudder 可在 FID 时退出(Phase 1 结束)

- 退出价格由 Rudder 指定的独立第三方估值师确定

- 也可将股份转入 Phase 2(建设-运营至 COD)

- 转入时按 FID 销售价格折算

Governance & Protections治理与保护

- Reserved matters aligned with Rudder’s majority capital contribution

- Clear gate in June 2026 after pre-DD review: proceed to long-form or walk away

- 保留事项与 Rudder 的多数出资地位匹配

- June 2026 明确决策节点:完成 pre-DD 审查后,决定继续或退出

Forecast & Exit Pathway预测与退出路径

Exit Pathway at FIDFID 退出路径

Exit Timing退出时机

At Final Investment Decision (FID), ESR facilitates entry of long-term, lower-cost infrastructure capital (super funds, infra funds).

Devex investors realise value uplift at FID exit.

在 FID 时,ESR 促成长期低成本基础设施资本进入(养老基金、基建基金等)。

Devex 投资者在 FID 退出时实现价值提升。

Capital Transaction资本交易

ESR manages transaction execution and handover to incoming investors.

Devex investors can:

- Exit fully at FID and realise returns, or

- Reinvest alongside ESR and new capital in the build-own-operate phase

ESR 负责交易执行及向新投资人移交。

Devex 投资者可:

- 完全退出并在 FID 实现回报,或

- 再投资与 ESR 及新资本共同进入建设-运营阶段

ESR’s RoleESR 的角色

Acts as developer and transaction sponsor, leveraging:

- Market relationships with capital

- Proven track record on capital raising and project delivery

Ensures seamless transition and alignment between Devex investors and long-term ownership.

作为开发商及交易发起人,借助:

- 与资本方的市场关系

- 在资本募集及项目交付方面的过往业绩

确保 Devex 投资者与长期持有者之间平稳过渡。